-

Red Sox Reportedly “Checked In” On Trade For 32-Year-Old Star - 12 mins ago

-

How Biden Ignored Warnings and Lost Americansâ Faith in Immigration - 16 mins ago

-

Saquon Barkley Calls Out Eagles Teammates Over âAwfulâ Sideline Energy - 46 mins ago

-

Katy Perry Posts Photos With Justin Trudeau Amid Romance Rumors - about 1 hour ago

-

One dead, at least 12 arrested, after police shooting in Anaheim - about 1 hour ago

-

How to Watch Broncos vs Raiders: Live Stream NFL, TV Channel - about 1 hour ago

-

The Impact of Trumpâs Slipping Approval Rating - 2 hours ago

-

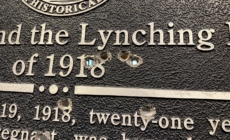

Bullet-Riddled Marker Honoring 1918 Lynching Victim Finds Museum Home - 2 hours ago

-

Superpower Competition: The Missing Chapter in Trumpâs Security Strategy - 2 hours ago

-

Blue Jays Urged To Retain Bo Bichette On $210 Million Contract - 3 hours ago

How Trumpâs Soybean Deal Compares With Past US Exports to China

U.S. President Donald Trump announced a soybean deal on Thursday following his talks with Chinese President Xi Jinping, months after Beijingâs purchases ground to a near halt in retaliation for Trumpâs tariffs on Chinese goods.

Chinaâs reported pledge to buy 12 million metric tons through January, followed by an annual 25 million tons beginning next year, has brought relief to U.S. farmers in the middle of this yearâs export cycle. Still, analysts say the deal will merely reset trade volumes to pre-tariff levels and warn that U.S. producers should seek new markets to insulate against future trade tiffs.

Newsweek contacted the American Soybean Association, the U.S. Department of Agriculture and Chinaâs Ministry of Commerce for comment via email.

Why It Matters

China is the worldâs largest soybean importer and has long been the top buyer of U.S. soybeans, accounting for roughly half of American exports in recent yearsâdown from about 60 percent before the first round of tit-for-tat tariffs in 2018.

Soybeans are the United Statesâ most valuable agricultural export, but the trade war has again highlighted the industryâs heavy reliance on China and the leverage this gives the U.S. economic rival.

What To Know

Following Thursdayâs meeting with Xi in South Korea, Trump wrote on Truth Social that he was âextremely honored by the fact that President Xi authorized China to begin the purchase of massive amounts of soybeans, sorghum, and other farm products.â

The import pledge, which Beijing has not confirmed, would bring total U.S. soybean exports to China to 18 million metric tonsâdown 32 percent from last year and marking the weakest year for American soy since 2018.

âIn the past five years, Chinaâs share of U.S. soybean exports has remained roughly unchanged at about 53 percent,â the Center for Strategic and International Studies wrote in a recent analysis. âUnless the U.S. soybean industry diversifies into other markets, it will remain exposed to coercive Chinese economic statecraft in the future.â

China has been diversifying its imports by increasing purchases of lower-cost soybeans from Brazilâits top supplierâand Argentina. Analysts say Beijing is unlikely to reverse this trend, even if relations with Washington stabilize.

The deal also included trade and tariff concessions from both sides. Trump agreed to delay his threatened 100 percent tariff on Chinese goods and reduce an existing duty on certain fentanyl precursor chemicals from 20 percent to 10 percent. In return, China postponed for at least one year its planned export restrictions on rare earth elements, which are crucial for defense and high-tech industries.

What People Are Saying

Texas Agriculture Commissioner Sid Miller said in a statement: âTexas soybean growers and producers across the country can rest easier knowing their product will find a strong and stable market.â

Economist Robin Brooks wrote on X: âU.S.-China trade deal: (i) trade negotiators will think we conceded far too much for soybeans; (ii) China hawks will say we look weak; (iii) foreign allies will be even more reluctant to join on things like secondary tariffs for fear the U.S. does an end-run trade deal.â

What Happens Next

It remains to be seen how successful U.S. exporters will be at expanding their share of the global soybean market.

Meanwhile, Japan signed a deal in September to boost annual purchases of American food and agricultural goods to $8 billion. Japanâthe U.S.âs sixth-largest soybean importerâimported $1.31 billion worth of American soy products last year.

Source link