-

Map Shows US States With Highest Levels Of Long COVID - 7 mins ago

-

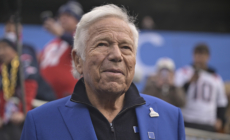

Patriots Owner Robert Kraft Once Again Denied Induction into Hall of Fame - 42 mins ago

-

The Alluring Dream That Black America Needs to Wake Up From - 43 mins ago

-

Brooke Shields’ 2-Word Nickname for George H. W. Bush - about 1 hour ago

-

The Secret Behind America’s Moral Panic - about 1 hour ago

-

Ex-Congressman on Bondi Pick: Bag of Peanut Butter Is ‘Better Than Gaetz’ - 2 hours ago

-

Chuck Scarborough to Step Down as WNBC News Anchor After 50-Year Career - 2 hours ago

-

‘Wordle’ Today #1,252 Answer, Hints and Clues for Friday, November 22 - 2 hours ago

-

The UK Faces a Dilemma: Cozy Up to Trump or Reconnect With Europe? - 3 hours ago

-

NYT ‘Connections’ November 22: Clues and Answers for Game #530 - 3 hours ago

Potential Obstacle to Trump Media’s Merger Appears to Have Been Cleared

The threat of a last-minute obstacle to the merger of former President Donald J. Trump’s social media company and a cash-rich shell company appears to have subsided.

Two early founders of Trump Media & Technology Group reached a temporary truce with Mr. Trump’s company at a hearing on Saturday morning in Delaware Court of Chancery. The agreement would preserve the two founders’ right to a significant equity stake in the parent company of Truth Social until a judge hears further arguments on the merits of their lawsuit.

The lawsuit, filed on Feb. 28 by a company controlled by Wes Moss and Andy Litinsky, had the potential to delay a scheduled March 22 vote by shareholders of Digital World Acquisition Corp. on the long-delayed merger with Trump Media.

If shareholders approve the merger, it would give Trump Media more than $300 million in badly needed cash to keep operating. The deal would also boost Mr. Trump’s net worth by more than $3 billion, based on Digital World’s current stock price.

“No one is suggesting I should do anything to interfere with the closing,” Vice Chancellor Sam Glasscock III of Delaware Chancery Court said of the shareholder vote. He later added, “I’m pretty confident we can work something out.”

The agreement was reached just days after another Delaware Chancery Court judge refused to delay the merger in response to a lawsuit filed by a company controlled by Patrick Orlando, the former chief executive officer of Digital World and the original sponsor of the shell company known as a special purpose acquisition company.

Mr. Orlando, Mr. Moss and Mr. Litinksy were early participants in talks that ultimately led to the announcement of a proposed merger between Trump Media and Digital World in October 2021. But the deal was delayed, in part, because of an investigation by the Securities and Exchange Commission into those negotiations, which took place before Digital World went public in September 2021.

Last summer, Digital World agreed to pay $18 million to the S.E.C. as part of a settlement to resolve the investigation. Regulators had said those early merger talks violated federal securities laws because they were not properly disclosed to investors. Special purpose acquisition companies, or SPACs, are not supposed to have a deal lined up before raising money from the public.

Mr. Moss and Mr. Litinsky were contestants on Mr. Trump’s reality television show “The Apprentice.” Shortly after he left the White House in January 2021, the two men talked to Mr. Trump about creating a social media company.

They claim in their lawsuit that Trump Media has a plan to severely dilute their equity stake in the company they control, United Atlantic Venture, by issuing more shares. But a lawyer for Trump Media said during the hearing that the company has no such intention.

Vice Chancellor Glasscock said that if that were true, “maybe the whole thing goes away.”

The potential merger comes as Mr. Trump is on the verge of wrapping up the Republican nomination for president. It also comes as he is facing a deadline to cover a $454 million penalty imposed upon him by a New York judge in a civil fraud case. Mr. Trump is also facing rising legal bills as he defends himself against charges in four criminal cases.

After the merger, Mr. Trump would own roughly 79 million shares in a publicly traded company. But a provision in the merger agreement currently prevents him from selling those shares to raise cash for six months.