-

Fans React to Trace Cyrus’ Plea to Dad Billy Ray Cyrus - 8 mins ago

-

Trump Vows to Release Records on Kennedy and King Killings - 22 mins ago

-

Stakes are high for Newsom and California when Trump visits L.A. wildfires - 38 mins ago

-

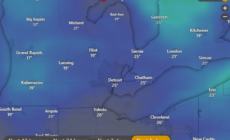

Detroit Weather Forecast: When Will Temps Warm Up? - 43 mins ago

-

Senate Pushes Hegseth Toward Approval as G.O.P. Discounts New Allegations - about 1 hour ago

-

Clergy Vows to Resist Trump’s Church Immigration Crackdown - about 1 hour ago

-

Heidi, Spencer Pratt sue L.A. after Palisades fire burns home - about 1 hour ago

-

S&P 500 Hits Record High Amid Strong Earnings and Easing Inflation Concerns - 2 hours ago

-

Red Sox Tabbed ‘Likely Landing Spot’ For $200 Million Franchise-Changing Alex Bregman - 2 hours ago

-

Fight breaks out over Pokémon cards at a Los Angeles Costco - 2 hours ago

Controversial Mortgage Fees to Change Under New Bill

Congress is set to consider legislation designed to cancel specific proposed changes to loan-level price adjustments by the Federal National Mortgage Association (Fannie Mae) and credit fees charged by the Federal Home Loan Mortgage Corporation (Freddie Mac).

The bill, introduced by Republican Representative Stephanie Bice on January 9, seeks to reverse recent pricing framework updates implemented by the Federal Housing Finance Agency (FHFA) to address affordability concerns and maintain liquidity in the housing market.

Why It Matters

Housing affordability has been a growing concern in the United States, with interest rates and housing costs placing additional burdens on middle- and low-income families. According to data from the Federal Reserve Bank of St. Louis, the third quarter of 2024 saw the median sales price for homes reach $420,400. Home prices have also increased by nearly 50 percent since 2020, according to the data.

Paul J. Richards/Getty Images

What to Know

HR 258 is a direct response to FHFA policies, including the recalibrated up-front fee matrices for mortgage loans announced in January 2023.

Proponents said that these adjustments aimed to ensure equitable access to homeownership while bolstering Fannie Mae and Freddie Mac’s financial positions. However, critics argued that some fee increases disproportionately affect middle-income borrowers and first-time homebuyers.

When the change was implemented, it faced significant pushback, leading FHFA to clarify the fee changes.

Bice’s bill would bar the FHFA from implementing the new pricing framework for mortgages that was put into place in 2023. While fee reductions were implemented for certain low-income borrowers, borrowers with a debt-to-income ratio greater than 40 percent paying an additional fee.

According to the National Association of Home Builders (NAHB), “lowering fees for low- to moderate-income borrowers and first-time homeowners is a positive step to making homeownership more affordable and attainable.” However, NAHB opposes fee increases on borrowers with higher credit quality.

Under the framework, borrowers with a credit score above 740 could be charged a higher fee than under the previous framework.

“In the short term, this may increase homeownership among the targeted group, but I’m afraid it could decrease homeownership among the middle class,” Jerry Howard, CEO of the National Association of Home Builders, told Newsweek in 2023 when the changes were announced. “I’m not sure that we’re not robbing Peter to pay Paul here.”

For the FHFA to close the homeownership gap by bringing down costs for some borrowers, the agency said it had to compensate for the reduction by raising the costs for borrowers with higher credit scores.

Larry Kudlow, the former National Economic Council Director under President Donald Trump, said at the time that the changes were equivalent to a “middle-class tax hike.”

In response to industry concerns, FHFA clarified that the updated framework aligns pricing more closely with the financial risks and performance of backed loans.

“They will provide reliable liquidity to the market while also providing more targeted support for creditworthy borrowers limited by income or wealth,” FHFA stated in April 2023.

Sandra L. Thompson, director of the Federal Housing Finance Agency added at the time that it was a “misconception” that high credit-score borrowers were being charged more so lower-credit borrowers could pay less. Thompson said many borrowers with high credit scores or large down payments would actually see fees decrease.

Public feedback gathered through a May 2023 Request for Input also highlighted tensions between financial stability and borrower equity.

What People Are Saying

Sandra L. Thompson, director of the Federal Housing Finance Agency, said in a 2023 press release: “These changes to upfront fees will strengthen the safety and soundness of the Enterprises by enhancing their ability to improve their capital position over time. By locking in the upfront fee eliminations announced last October, FHFA is taking another step to ensure that the Enterprises advance their mission of facilitating equitable and sustainable access to homeownership.”

Carl Harris, chairman of the National Association of Home Builders (NAHB) and a custom home builder from Wichita, Kansas, said in a press release: “NAHB commends President Trump for acting on day one to make housing a national priority by issuing an executive order that seeks to lower the cost and increase the supply of housing. President Trump understands that America is facing a housing affordability crisis and the only way out of this crisis is to remove barriers like unnecessary and costly regulations that are raising housing costs and preventing builders from building more attainable, affordable housing. NAHB has released a 10-point housing plan to remove the impediments to increasing the nation’s housing supply and we look forward to working with the Trump administration and Congress to enact sound policies that will allow builders to boost housing production and affordability.”

What’s Next

HR 258 has been referred to the House Committee on Financial Services and awaits further deliberation. If passed, the bill would eliminate the recent fee structure changes and require FHFA to reassess its pricing priorities. Meanwhile, the FHFA’s current framework, effective since May 2023, remains in place, influencing mortgage pricing across the country.

Source link