-

Alysa Liu Reveals the Meaning Behind Her Now-Viral Olympics Hairstyle - 14 mins ago

-

L.A. beaches could be managed by the federal government - 24 mins ago

-

Man Accused of Murdering His Father Once Sought to Seize Stranger’s Baby - 29 mins ago

-

Los Angeles man dies in accident at Northern California ski resort - about 1 hour ago

-

Bud Cort, Who Starred in 1971’s ‘Harold and Maude,’ Dies at 77 - about 1 hour ago

-

Lawmakers Question Bondi Over Justice Dept. Under Her Watch - 2 hours ago

-

2 Olympic Skiers Banned After Shocking Qualification Round Incident - 2 hours ago

-

Woman ‘Bewildered’ By BF’s Dark Take On Relationship: “No Value” - 3 hours ago

-

Baby, 17 Days Old, Found Dead From Fire That Killed Her Mother - 3 hours ago

-

L.A. man who went on seven-day tree-slashing rampage is sentenced - 3 hours ago

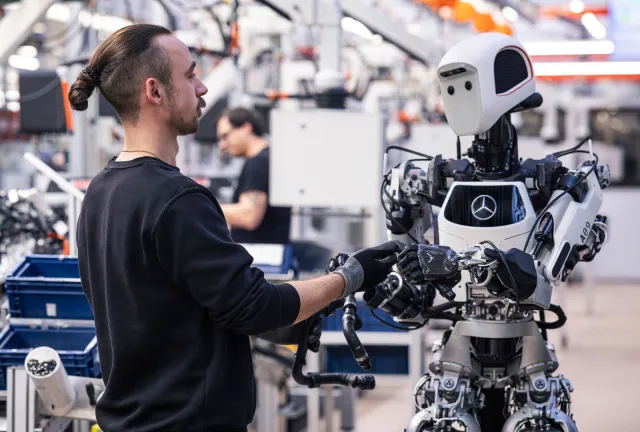

Germany’s Automakers Go to War With China, For China

Automakers are losing ground in the world’s most important market, China. American, Scandinavian and European car companies are scrambling to catch up as their Chinese competition sets new speed milestones, rolls out new products and keeps what’s already working fresh with frequent technology and appearance updates.

Audi, Porsche, BMW and Mercedes-Benz have all seen annual sales drops in China over the last five years, with the larger volume automakers seeing the biggest falls.

While mass market car companies are pulling back from their original product and sales plans, and thoughtfully and relatively slowly moving forward, German luxury automakers are pressing forward with a sense of unprecedented urgency, not just in a bid to stabilize their market share, but in hopes of making gains.

Mercedes-Benz plans to launch 40 vehicles in the next two years, 20 new and 20 refreshed. There’s new architecture on the horizon and a reinvigorated AMG performance brand lineup coming. Equally as important is the company’s push for new engines, those that are far more efficient than what is in the market today.

“The main strategy to ensure that Mercedes-Benz remains competitive for the next 140 years is to build the world’s most desirable cars,” a spokesperson for Mercedes-Benz told Newsweek. “This means that Mercedes-Benz must deliver an exclusive combination of exceptional design and advanced technology, outstanding refinement and craftsmanship, a sublime ride and drivetrain and world class safety systems.”

China’s residents are open to multiple powertrain types including hybrids, plug-in hybrid, extended range electric and battery-electric models. Unlike the European Union and the U.K., China has not set strict regulations for emissions that would force buyers into pricey, zero emissions replacements for their daily driver.

Research by EY’s Mobility Lens Forecaster, an artificial intelligence-enabled forecasting model, suggests that a decade from now, battery-electric vehicles will represent just 50 percent of the sales in Europe, China and the U.S. despite major pushes from automakers and governments.

EY expects China to have over 50 percent of new vehicle sales of battery-electric vehicles (BEVs) by 2033, and more than 81 percent of the market by 2044. EY calls full BEV adoption in China “elusive” before 2050.

By 2032, BEVs will account for over 50 percent of vehicle sales in Europe, the company predicts, but will strengthen to 95 percent market share by 2041.

With the impact of the Big, Beautiful Bill being felt nationwide, the U.S.’s 50-percent new EV purchase rate has been pushed back five years, to 2039, predicts EY.

Audi is pursuing a product cadence similar to Mercedes-Benz. By the end of 2025, Audi will have introduced 20 new models in 24 months, but the company admits that it has stumbled.

A new era of Audi all-electric, plug-in hybrid and combustion-engine vehicles is on the way, as was previewed by the company’s Concept C sports coupe in September.

“The way we design our vehicles is the way we will shape our company,” said Audi’s Chief Executive Officer Gernot Döllner. “The new design philosophy is therefore a corporate principle for Audi that will be reflected in the design of the model portfolio and the product range as well as in the organizational structure of the company,” the company clarified in a press release.

“The phase of taking stock is over. Now is the time to look to the future and pick up speed. We are focusing on what really matters to set standards in design and quality,” Döllner said.

BMW has prepared a less expedient new product onslaught. The first of its Neue Klasse next-generation models debuted at IAA Mobility, a transportation industry trade show and has received praise for its engineering, but scorn for its looks. A sedan version built on the same architecture is due soon.

Headlines in Germany’s press were quick to point out the number of Chinese brands at IAA Mobility this autumn, poised and ready to make even bigger splashes in Europe than ever before, with models that have quickly evolved to the point of not being easy to ignore by automakers far and near.

Asia-based brands including BYD, Changan, Forthing and Hongqi had exhibitions at the show, as well as those owned by Chinese companies like Polestar and Lotus, which are under the Geely Holding Group umbrella.

Those automakers aren’t following usual product cadences long held by Western automakers. Traditionally, a product debuts, receives a mid-generation technology and design refresh three years into its sale, and by year six or seven, a new generation of product on an updated platform is ready for its debut.

Chinese automakers are continuously debuting new models and hyping their brands with record-breaking variants. A racetrack in the heart of Europe, the heralded Nürburgring Nordschleife in Nürburg, Germany, has had its record lap times taken over by the Chinese. The YANGWANG U9 Xtreme is has become the fastest electric sports car to go around the track and the Xiaomi SU7 Ultra is the fastest electric luxury sedan.

The best-performing Chinese automakers are routinely freshening technology, with customers and automakers benefitting from connected technologies that connect cars, trucks and SUVs to the cloud with modems that have the ability to receive and install over-the-air software updates in a matter of minutes. Those vehicles are more highly customizable than ever before, with personal comfort and convenience technologies highly sought after.

The newest models from German companies are capable of the same, but less than a handful have as much connected vehicle technology as what is found in the newest electric Chinese models.

There are more overtly noticeable differences between early models from Chinese manufacturers and those by Germans. While quality of new luxury models has fluctuated greatly in recent years, as measured by J.D. Power’s U.S. Vehicle Dependability Study and U.S. Initial Quality Study, Chinese automakers have risen from having the same types of fit and finish issues Hyundais and Kias had two decades ago to deliver good mass market and premium models.

Advances in manufacturing technology, and a heavy reliance on artificial intelligence and robots to make Chinese electrified vehicles more precisely crafted than those put together by humans, upping quality. Factories that those companies use are new, many built in record time.

The German auto industry is in the midst of a production conundrum. Elevated production expenses in the EU, related largely to energy use and labor costs, and aging factories built during the post-World War II industrial boom and refreshed at the dawn of the modern car era, have caused many to rethink their production plans. Add to that the Trump administration’s tariff imposition and lessons learned from the COVID-19 pandemic, which have put the focus on regional production rather than hub-and-ship style manufacturing.

Germany’s auto industry largely considers its history and reputation as a source of pride and asset. But, they’re working to shed a century of heavily-bureaucratic workplace decision making, striving to become more agile, and speed up production. All this while having to maintain positive financial margins despite economic headwinds, remake dated manufacturing plants for modern practices, and integrate evolving sustainability requirements. They’re also figuring out workforce next steps with tens of thousands of workers laid off in recent years.

Unlike Western automakers, Chinese companies do not have a hundred-year history and reputation to fall back on, nor do they have the tariffs counting against imports into China the way Western automakers do. They are product forward, not legacy bound, and their success will be measured by their ability to adapt in the coming years.

“Our 140-year heritage anchors this promise: the inventor of the automobile will keep building the world’s most desirable and most intelligent cars in every segment with a particular emphasis on conquest and further growth of our top-end vehicles and our bespoke luxury brands Mercedes-AMG, Mercedes G and Mercedes-Maybach,” the Mercedes-Benz representative said.

In addition to a long legacy, Germany’s luxury brands also offer elevated products compared to much of what is on the market in China. With rapid model evolution, those offerings are being taken to new heights more quickly.

China is looking to compete in earnest, with brands rolling out premium and luxury sub-brands, some of which are producing some of Newsweek’s Most Anticipated New Vehicles in 2026.

BMW Group and Audi were approached for comment for this story but did not reply to requests.

Source link