-

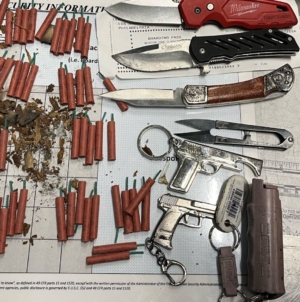

Woman’s Carry-on Flight Luggage Stuns TSA Officers - 22 mins ago

-

Under Pressure, Telegram Turns a Profit for the First Time - 28 mins ago

-

Hand-written signatures were a sticking point for young California voters - 38 mins ago

-

Colliding Drones Crash Into Crowd at Florida Holiday Show - 57 mins ago

-

‘Democrats Have Gone Beyond Soul Searching to Soul Spelunking’: 4 Writers Read the Party’s Fortune - about 1 hour ago

-

Winter Weather Warnings in 16 States As 14 Inches of Snow To Hit - 2 hours ago

-

House Ethics Committee Is Expected to Release Report on Matt Gaetz’s Conduct - 2 hours ago

-

Astronomers Unveil Their Favorite Discovery of 2024 - 2 hours ago

-

Multiple Casualties Reported after Car Drives into Crowd in St Louis - 3 hours ago

-

China Hits Back at US Over Nuclear Weapons Alarm - 3 hours ago

Gold Price Closes In on $3,000 Milestone

Gold could reach $3,000 by the end of 2024 or sooner after several months of rising prices.

GoldPrice.org says that there has been a 45.93 percent increase in the price of an ounce over the past year, with a 6.58 percent increase in the last 30 days. As of October 3, the price is $2,642.45, and experts believe it will climb to a record $3,000 before the end of 2024.

“In March 2024, gold hit $2,070 and, even though the last six months have seen pushbacks and dips, gold continues to climb,” Nick Fulton, managing partner at

USA Pawn, told Newsweek. “When we saw $2,600 an ounce gold, I thought $2,800 by the end of the year. Now? We could see gold at $3,000 an ounce happen in a 30-day time span.”

A surge in the price of gold can be put down to several factors; these include newly lowered interest rates from the Federal Reserve; fresh investor attraction; and war in the Middle East, as gold is considered a safe-haven investment particularly in times of geopolitical conflict.

A spike in gold prices during a time of significant geopolitical unrest is no surprise, Michael Martin, vice president of market strategy at TradingBlock, told Newsweek.

“Ongoing conflicts, such as the war in Ukraine and tensions in the Middle East, have driven investors toward safe-haven assets like gold,” Martin said. “Global tensions have historically coincided with spikes in gold prices. For example, during the 1979 Soviet invasion of Afghanistan, gold more than doubled in value.”

GETTY

Matthew Jones, precious metals analyst at Solomon Global, told Newsweek that gold prices could reach $3,000 if Israel conducts retaliatory strikes on Iran. Tehran launched around 180 missiles at the Israelis on Tuesday, October 1, in response to Israel’s killing of Hamas and Hezbollah leaders.

“It now appears that the much-feared escalation into a regional war has sadly arrived, given the ballistic missiles fired into Israel yesterday; Israel has committed to a further retaliatory strike at both Iran’s oil refineries and nuclear sites,” Jones said. “Gold will hit and surpass $3,000 the very second that Israel launches its missiles.”

Aside from ongoing war in the Middle East, prices are seeing a push, thanks to new investors and a surge in eastern central banks buying gold.

“As a brick-and-mortar seller, we are seeing many first-time buyers. With gold seeing an increase of 25 percent in value the last six months, it is attracting new investors,” Fulton said. He also cited an increase in buying from central banks in China and India.

A report by Reuters said that the People’s Bank of China (PBOC) had bought gold for 18 consecutive months, and the value of its gold reserves rose to $182.98 billion at the end of August, compared with $176.64 billion at the end of July.

“We don’t see that any time soon this will subside,” Luciano Duque, chief investment officer at C3 Bullion, told Newsweek. “On the contrary, as big banks increase their gold holdings as they have done over the past two years, we could assume smaller banks will follow suit, and, for investors, it’s a wave that is growing.”

Photo-illustration by Newsweek/Getty

As well as this, some investors have avoided selling gold, “which has further limited supply and added upward pressure on prices,” Jones said. “With inflation easing but still present and the potential for more rate cuts, the outlook for gold remains positive for the remainder of 2024.”

“We believe that, in the short and medium term, there is no chance for any dip after reaching that mark [$3,000],” Duque said. “We think the sub-$2,000 gold price might be something we’ll probably never see again in our lifetime.”

Given the unlikely resolution of ongoing conflicts in the Middle East and Ukraine, a long-standing drop in the price of gold is not on the agenda.

“The problems in the Middle East will continue to drive gold, as any interruption in the production and transportation of oil will cause the return of inflation like a sledgehammer, and gold performs at its peak during times of high inflation,” Jones said.

Source link