-

Satellite Imagery Shows China Upgrading Aircraft Carrier Base - 24 mins ago

-

Aftershocks From 8.8-Magnitude Quake Rattle North Pacific - 25 mins ago

-

Trump Escalates Feud with Putin Ally - 59 mins ago

-

Countries Promise Trump to Buy U.S. Gas, and Leave the Details for Later - about 1 hour ago

-

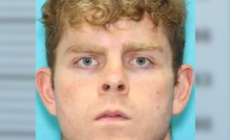

Who Is James Andrew McGann? Suspect Arrested Over Devil’s Den Killings - 2 hours ago

-

Russian Missile and Drone Attack Pummels Kyiv, Killing at Least 6 - 2 hours ago

-

America’s Best Continuing Care Retirement Communities 2026 Survey - 2 hours ago

-

25 Hospitalized After Delta Flight Is Hit by Strong Turbulence - 3 hours ago

-

Navy F-35 Jet Crashes in California, Pilot Safely Ejects: What We Know - 3 hours ago

-

All-Star Mason Miller Benched Wednesday As Surprising Trade Partner Emerges - 3 hours ago

Map Shows Where House Prices Are Rising and Falling Fastest

Despite dwindling sales, home prices continue to climb in much of the country and especially in the Northeast, where New York reported the highest year-over-year gain in May at 7.4 percent, according to the latest S&P CoreLogic Case-Shiller Index.

But even as prices continue inching up, they are doing so at a slower pace than ever since the outbreak of the COVID-19 pandemic. The index found that all nine U.S. census divisions reported an overall annual price gain of 2.3 percent in May, down from 2.7 percent in April.

The 10-city composite index reported an annual increase of 3.4 percent, down from 4.1 percent a month earlier, while the 20-city composite posted a 2.8 percent year-over-year gain, down from 3.4 percent in April.

“May’s data continued the years’ slow unwind of price momentum, with annual gains narrowing for a fourth consecutive month,” Nicholas Godec, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices, said in a press release shared with Newsweek.

“Seasonal momentum is proving weaker than usual, and the slowdown is now more than just a story of higher mortgage rates. It reflects a market recalibrating around tighter financial conditions, subdued transaction volumes, and increasingly local dynamics. With affordability still stretched and inventory constrained, national home prices are holding steady, but barely.”

Where Home Prices Are Rising—And Where They Are Falling

The Northeast and the Midwest, where the shortage of homes remains most acute, experienced the highest price growth in May, according to the index.

After New York, Chicago reported the second-biggest annual home price gain in May of all major U.S. metros analyzed by S&P and CoreLogic, up 6.1 percent. It was followed by Detroit with a year-over-year increase of 4.9 percent.

At the other end of the spectrum there’s the South, where metros in states like Florida and Texas, which have gone through a significant construction boom over the past few years, are reporting annual price drops.

Tampa reported the steepest year-over-year price decline in May, at -2.42 percent. It was followed by Dallas and San Francisco both at -0.64 percent, and Denver at -0.01 percent.

What Does The Index Tell Us About The State Of The Housing Market

While prices are still rising at the national level, it is significant how much slower the pace of their growth has gotten in the past few months. This is happening mostly because the U.S. housing market has reached a breaking point in terms of affordability: even as demand remains high and millions of Americans dream of homeownership, many just cannot afford it at the moment.

The 30-year fixed-rate mortgage is still hovering near the 7 percent mark, and experts do not expect rates to get lower than 6 percent any time soon. Property taxes are much higher than they used to be five years ago, and home insurance premiums are rising as the threat of natural disasters grows with climate change.

Buyers’ reluctance to engage in the market, which has been exacerbated by recent fears over the direction taken by the U.S. economy under the helm of President Donald Trump, has caused a pileup of unsold homes across the country—especially in areas where developers have built more new homes.

This shrinking of demand is likely to lead to a normalization of the U.S. market after years of overheating, experts say—but low inventory across the country has been keeping prices up so far.

Things may change as a result of a bipartisan housing package just moving through the legislature right now. Under the ROAD to Housing Act, lawmakers on both sides of the political spectrum are trying to boost the country’s home supply and improve affordability.

S&P CoreLogic Case-Shiller Index

Source link