-

For OpenAI and Anthropic, the Competition Is Deeply Personal - 19 mins ago

-

ICE Detains Reporter Estefany Rodriguez Florez in Nashville - about 1 hour ago

-

How Candidates Are Using Winks and Posts to Seek Crypto and A.I. Cash - 2 hours ago

-

Video Shows Destruction of Michigan’s Deadliest Tornado in 46 Years - 2 hours ago

-

At Trump’s Summit in Miami, Bolivia Makes a Political U-turn Toward the U.S. - 3 hours ago

-

‘Wuthering Heights,’ MAGA Style - 3 hours ago

-

Yankees Could Land Bryce Harper With One Simple Roster Move: Analyst - 4 hours ago

-

Russia Attacks Kharkiv and Kyiv in Ukraine - 4 hours ago

-

German Shepherd Siblings Playing Tag Win ‘Pet of the Week’ - 4 hours ago

-

Daylight saving time returns — here’s when to change your clocks - 4 hours ago

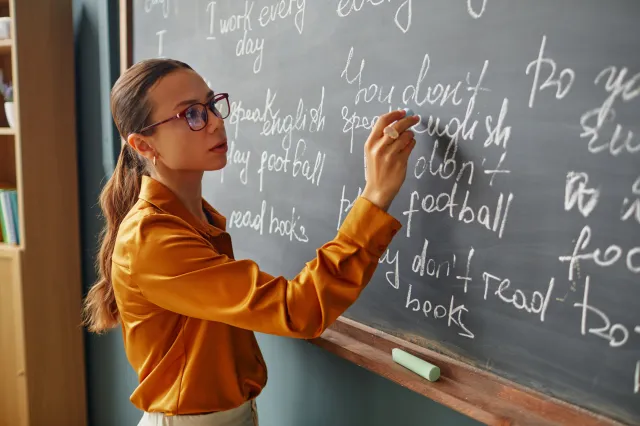

Teachers Could Be Exempt From Income Tax Under 2027 State Plan

A proposed bill in Nebraska could see teachers made exempt from state income tax.

Why It Matters

Nebraska, like a number of states, has experienced a shortage of teachers. The Nebraska Department of Education found in a survey of teaching professionals that overall, 135 districts and systems—representing 38.03 percent of the respondents—in the state reported unfilled positions at the start of the 2025 to 2026 school year. In total, they said 489 positions were unfilled by fully qualified personnel, with a further 111 positions left completely vacant for the year. Staffing gaps remain in several critical areas, with the report highlighting continued shortages in special education, elementary education, and science and mathematics.

According to the department, the average starting salary for a teacher in the Cornhusker State is $46,324, with an overall average salary of $63,527.

What To Know

In an effort to combat the shortage, Democratic State Senator Margo Juarez has introduced a bill, which would exempt “certificated teachers, paraeducators, and paraprofessionals from state income taxation.”

The income tax break would only apply to money earned as a working teacher, so other forms of income would remain taxable. The proposal includes state and private school teachers.

No U.S. state currently exempts teachers from paying state income tax on their wages. While proposals to create such exemptions have surfaced in several states, none have been enacted into law. California lawmakers in 2017 considered a bill that would have exempted teachers from state income tax after five years of service, but the measure did not pass and did not become part of the state tax code. That proposal was also made as the state faced a teacher shortage.

Some states have provided more limited forms of tax relief for teachers. These usually come in the form of tax credits or deductions rather than broad wage exclusions. For instance, certain states offer refundable credits or deductions to help offset classroom supply expenses or provide modest retention incentives.

While teachers are not specifically targeted, the educators in some states still pay no state income tax on their earnings because those states do not levy a personal income tax on any wages. These states include Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Wyoming, and New Hampshire.

While Nebraska still has a teacher shortage, it has improved its numbers over the last year. There are nearly 180 fewer unfilled positions in the current academic year when compared to the previous school year.

What Happens Next

The bill remains in committee, and if it is advanced and approved by the state legislature, the tax exemption would take effect in January 2027.

Source link