-

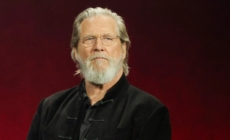

Jeff Bridges Wants to Return to Most Beloved Role - 8 mins ago

-

Trump’s Tariff Threats Chill Italy’s Cheese Makers - 30 mins ago

-

Tomato Price Warning Issued Over Trump Tariffs - 44 mins ago

-

Can Trump Really Negotiate Peace in Ukraine, Russians Wonder - about 1 hour ago

-

How to Watch Everton FC vs. Manchester City: Live Stream Premier League, TV Channel - about 1 hour ago

-

Anti-Trump Protest Organizers Raise Alarm Over Possible ‘Military Force’ - 2 hours ago

-

What Is Lost When We Scare Away Foreign Students - 2 hours ago

-

Millennial Woman Slams Comparisons of 2008 Recession Survival to Now - 3 hours ago

-

Israeli Attacks Kill Dozens in Gaza, Health Ministry Says - 3 hours ago

-

Commentary: In their golden years, this isn’t the country they expected to be living in. So what now? - 3 hours ago

Why China Isn’t Included in Trump’s 90-Day Pause on Reciprocal Tariffs

President Donald Trump announced a temporary 90-day pause on his administration’s broad tariff scheme for more than 75 countries — but excluding China, which he accused of showing “disrespect” to global markets.

Instead, effective immediately, the president said tariffs on Chinese imports will rise to 125 percent, deepening the trade rift between the world’s two largest economies.

Amid a global market meltdown, Trump reversed course by pausing most of his “reciprocal” tariffs on U.S. trade partners, while sharply increasing the tariff rate on Chinese imports to 125 percent.

Global markets surged on the news, which was delivered via a Truth Social post around 1:30 p.m. ET.

Why China Isn’t Included in Trump’s 90-Day Pause

The move came after escalating global tension and extreme turmoil in both stock and bond markets, with trading partners retaliating and investors pulling out of U.S. assets in response to tariff hikes that took effect at midnight. Trump’s reversal shifted the trade conflict into a more direct U.S.-China trade war.

“Due to China’s lack of respect for global markets, I am raising the tariff on Chinese goods to 125 percent, effective immediately,” Trump wrote. Countries that refrained from imposing retaliatory measures were given a temporary reprieve. “I have authorized a 90-day pause, with a substantially lowered reciprocal tariff of 10 percent during this period,” he added.

Photo by Kevin Dietsch/Getty Images

The pause was confirmed by Treasury Secretary Scott Bessent, who said in a hastily called press conference from outside the Oval Office that the president was maintaining the 10 percent baseline tariffs on most global imports but rewarding nations that cooperated.

However, China’s exclusion highlights Trump’s hardline approach toward Beijing. “Do not retaliate, and you will be rewarded,” Bessent told reporters, noting that countries like Japan, South Korea, and India had expressed willingness to negotiate. “I’ll point out that these nations are all around China. We also have Vietnam coming today,” Bessent added in an interview with Fox Business.

Trump’s exclusion of China signals a shift from a global trade conflict to a more targeted confrontation with Beijing, which provided some measure of relief to markets. The administration’s rationale appears to center on China’s failure to negotiate or de-escalate the trade war, coming after Beijing hiked tariffs on U.S. goods to 84 percent in its own bout of reciprocity.

“China has chosen the opposite direction,” said Commerce Secretary Howard Lutnick, adding that most other nations had reached out to U.S. officials to seek resolution. Bessent echoed that view, saying China’s “insistence on escalation” led to the decision to raise tariffs instead of extending a temporary reprieve.

How Has the Market Responded?

Financial markets responded dramatically to Trump’s announcement. The S&P 500 jumped by 5.6 percent, the Nasdaq surged over 8 percent, and the Dow Jones Industrial Average climbed by more than 2,000 points for a gain of 6 percent in afternoon trading. These gains came amid a period of extreme volatility and sustained losses, with the S&P having dropped more than 18 percent since mid-February.

Oil prices also swung sharply, initially plunging to a four-year low amid fears of slowing global economic growth due to the escalating trade war, then rebounding after Trump announced the 90-day pause on most tariffs.

While investors welcomed the easing of tariffs for most countries, market strategists remain cautious. “Markets are looking for signs that a trade de-escalation is coming,” said Gennadiy Goldberg of TD Securities to the Associated Press.

JPMorgan Chase CEO Jamie Dimon also warned that a recession remained “probably” likely, citing compounded shocks to trade, consumer confidence, and financial markets.

What People Are Saying

The Chinese Ministry of Commerce stated before the turnaround: “If the U.S. insists on further escalating its economic and trade restrictions, China has the firm will and abundant means to take necessary countermeasures and fight to the end.”

Scott Lincicome, VP, General Economics, Cato Institute, told CNN: “Markets are relieved a bit, but I don’t know how you could possibly think the U.S. is a sound, safe and stable place to invest when the president is flipping tariffs on and off like a light switch and there could be more of these things in a mere 90 days. So a bit of a reprieve, but we’re definitely not out of the woods.”

Trade expert Henry Gao, professor at Singapore Management University, told Newsweek: “Trump appears to be taking a more coercive approach—using tariffs to pressure other countries into siding with the U.S. This could succeed to some extent, but it risks fragmenting the global economy into rival blocs. In a worst-case scenario, it could even provoke China into escalating tensions, including a possible invasion of Taiwan or other neighbors.”

Bill Ackman, the billionaire hedge fund manager and Trump ally, on X: “This was brilliantly executed by @realDonaldTrump. Textbook, Art of the Deal.”

What Happens Next?

Bessent previously said it could take months to strike bespoke deals with dozens of countries on tariff rates. He said on Wednesday that the 10 percent “baseline” tariffs will remain in place for most countries.

Additionally, Beijing imposed restrictions on doing business with nearly a dozen American companies and stated that it was launching a new challenge to the American tariffs at the World Trade Organization.

Source link